Private Practice COVID-19 Resources

It's an uncertain and unprecedented time for us all, both as practice owners and as members of our communities. The continually developing situation with COVID-19 has undoubtedly been on all of our minds, and we share your desire to do whatever we can to help our patients, our teams, and our families stay safe and well. We're also here to help ensure your business survives this crisis and is positioned for new business cycle growth afterwards.

Ways to kickstart revenue in your practice as you re-open or ramp up.

Government Relief Programs

Paycheck Protection Program

Highlights:

Action: Contact your local SBA-approved lender - you can reach the SBA by email at answerdesk@sba.gov or by phone at 1-800-827-5722

Further Information:

Schedule a 1:1 COVID-19 Practice Response Consultation

Economic Injury Disaster Loan Assistance Program (EIDL)

Highlights:

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. The SBA's Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

Further Information:

Schedule a 1:1 COVID-19 Practice Response Consultation

Family First Act

Highlights:

The Families First Coronavirus Response Act (FFCRA) requires certain employers to provide their employees with paid sick leave and expanded family and medical leave for specified reasons related to Covid-19. Employers will be reimbursed for the cost of eligible paid leave under these provisions in the form of tax credits. These regulations will remain in effect from 4/1/2020 - 12/31/2020. Employers with fewer than 50 employees may be exempt from certain provisions of the FFCRA if doing so would place an undue burden on the operations of the business.

Further Information

Schedule a 1:1 COVID-19 Practice Response Consultation

Practice Development Opportunities

Pivot Hearing can help you develop and execute a project list for this time while your office is closed or slower than normal so that you emerge from the COVID-19 situation poised for new business cycle growth.

What we do

Increased Patient Flow

Pivot Hearing delivers increased patient flow through marketing plan development, execution, and digital transformation.

Lean Operations Design

Pivot Hearing helps you design lean operations to scale and dominate in a changing marketplace.

Premier In-Clinic Patient Experience

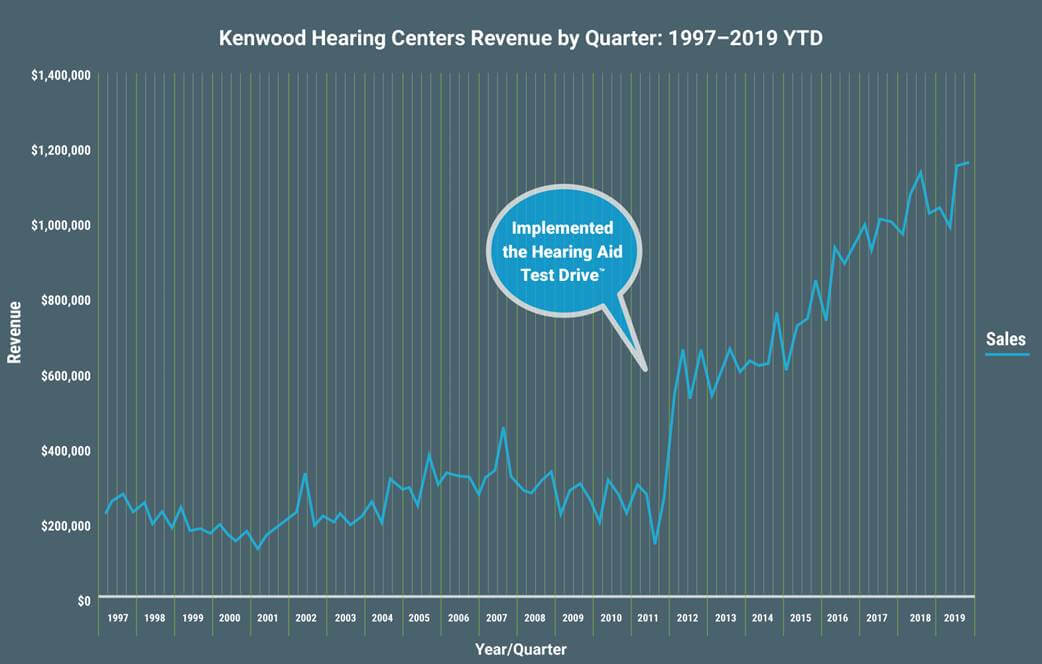

Pivot Hearing helps you create a premier in-clinic patient experience, including the Hearing Aid Test Drive™ process and sales training.

It’s an uncertain and unprecedented time for us all, both as practice owners and as members of our communities. The continually developing situation with COVID-19 has undoubtedly been on all of our minds, and we share your desire to do whatever we can to help our patients, our teams, and our families stay safe and well. We’re also here to help ensure your business survives this crisis and is positioned for new business cycle growth afterwards.

Pivot Hearing COVID-19 Playbook #3:

Ways to kickstart revenue in your practice as you re-open or ramp up.

(function() {

try{

var f = document.createElement(“iframe”);

f.src = ‘https://forms.zohopublic.com/lee35/form/COVID19Playbook3/formperma/7Rs64InBvXRmm03lrWtZyMZjxBDcCfKLc-DwpS7WjcI?zf_rszfm=1’;

f.style.border=”none”;

f.style.height=”600px”;

f.style.width=”100%”;

f.style.transition=”all 0.5s ease”;// No I18N

var d = document.getElementById(“zf_div_7Rs64InBvXRmm03lrWtZyMZjxBDcCfKLc-DwpS7WjcI”);

d.appendChild(f);

window.addEventListener(‘message’, function (){

var zf_ifrm_data = event.data.split(“|”);

var zf_perma = zf_ifrm_data[0];

var zf_ifrm_ht_nw = ( parseInt(zf_ifrm_data[1], 10) + 15 ) + “px”;

var iframe = document.getElementById(“zf_div_7Rs64InBvXRmm03lrWtZyMZjxBDcCfKLc-DwpS7WjcI”).getElementsByTagName(“iframe”)[0];

if ( (iframe.src).indexOf(‘formperma’) > 0 && (iframe.src).indexOf(zf_perma) > 0 ) {

var prevIframeHeight = iframe.style.height;

if ( prevIframeHeight != zf_ifrm_ht_nw ) {

iframe.style.height = zf_ifrm_ht_nw;

}

}

}, false);

}catch(e){}

})();

Pivot Hearing COVID-19 Playbook #2:

Clinical & operational considerations for re-opening your hearing care practice post-COVID-19.

(function() {

try{

var f = document.createElement(“iframe”);

f.src = ‘https://forms.zohopublic.com/lee35/form/COVID19Playbook2/formperma/1rJ4vRpJPw1AWo-Fv5HjEwCqot1z-axFgSg9ageTtjs?zf_rszfm=1’;

f.style.border=”none”;

f.style.height=”600px”;

f.style.width=”100%”;

f.style.transition=”all 0.5s ease”;// No I18N

var d = document.getElementById(“zf_div_1rJ4vRpJPw1AWo-Fv5HjEwCqot1z-axFgSg9ageTtjs”);

d.appendChild(f);

window.addEventListener(‘message’, function (){

var zf_ifrm_data = event.data.split(“|”);

var zf_perma = zf_ifrm_data[0];

var zf_ifrm_ht_nw = ( parseInt(zf_ifrm_data[1], 10) + 15 ) + “px”;

var iframe = document.getElementById(“zf_div_1rJ4vRpJPw1AWo-Fv5HjEwCqot1z-axFgSg9ageTtjs”).getElementsByTagName(“iframe”)[0];

if ( (iframe.src).indexOf(‘formperma’) > 0 && (iframe.src).indexOf(zf_perma) > 0 ) {

var prevIframeHeight = iframe.style.height;

if ( prevIframeHeight != zf_ifrm_ht_nw ) {

iframe.style.height = zf_ifrm_ht_nw;

}

}

}, false);

}catch(e){}

})();

Pivot Hearing COVID-19 Playbook #1:

Top 10 list of things you should be doing right now to work on your business even if you can’t currently work in it.

(function() {

try{

var f = document.createElement(“iframe”);

f.src = ‘https://forms.zohopublic.com/lee35/form/COVID19Playbook1/formperma/sejSkspyqRPgP-jWwtPZvMertnTmDnKM4QIDRjmAi9g?zf_rszfm=1’;

f.style.border=”none”;

f.style.height=”600px”;

f.style.width=”100%”;

f.style.transition=”all 0.5s ease”;// No I18N

var d = document.getElementById(“zf_div_sejSkspyqRPgP-jWwtPZvMertnTmDnKM4QIDRjmAi9g”);

d.appendChild(f);

window.addEventListener(‘message’, function (){

var zf_ifrm_data = event.data.split(“|”);

var zf_perma = zf_ifrm_data[0];

var zf_ifrm_ht_nw = ( parseInt(zf_ifrm_data[1], 10) + 15 ) + “px”;

var iframe = document.getElementById(“zf_div_sejSkspyqRPgP-jWwtPZvMertnTmDnKM4QIDRjmAi9g”).getElementsByTagName(“iframe”)[0];

if ( (iframe.src).indexOf(‘formperma’) > 0 && (iframe.src).indexOf(zf_perma) > 0 ) {

var prevIframeHeight = iframe.style.height;

if ( prevIframeHeight != zf_ifrm_ht_nw ) {

iframe.style.height = zf_ifrm_ht_nw;

}

}

}, false);

}catch(e){}

})();

Pivot Hearing COVID-19 Playbook #1:Top 10 list of things you should be doing right now to work on your business even if you can’t currently work in it.

Full Name*Email*

Phone*Practice Name*CAPTCHA

jQuery(document).ready(function($){gformInitSpinner( 36, ‘https://pivothearing.com/wp-content/plugins/gravityforms/images/spinner.gif’ );jQuery(‘#gform_ajax_frame_36’).on(‘load’,function(){var contents = jQuery(this).contents().find(‘*’).html();var is_postback = contents.indexOf(‘GF_AJAX_POSTBACK’) >= 0;if(!is_postback){return;}var form_content = jQuery(this).contents().find(‘#gform_wrapper_36’);var is_confirmation = jQuery(this).contents().find(‘#gform_confirmation_wrapper_36’).length > 0;var is_redirect = contents.indexOf(‘gformRedirect(){‘) >= 0;var is_form = form_content.length > 0 && ! is_redirect && ! is_confirmation;var mt = parseInt(jQuery(‘html’).css(‘margin-top’), 10) + parseInt(jQuery(‘body’).css(‘margin-top’), 10) + 100;if(is_form){jQuery(‘#gform_wrapper_36’).html(form_content.html());if(form_content.hasClass(‘gform_validation_error’)){jQuery(‘#gform_wrapper_36’).addClass(‘gform_validation_error’);} else {jQuery(‘#gform_wrapper_36’).removeClass(‘gform_validation_error’);}setTimeout( function() { /* delay the scroll by 50 milliseconds to fix a bug in chrome */ jQuery(document).scrollTop(jQuery(‘#gform_wrapper_36’).offset().top – mt); }, 50 );if(window[‘gformInitDatepicker’]) {gformInitDatepicker();}if(window[‘gformInitPriceFields’]) {gformInitPriceFields();}var current_page = jQuery(‘#gform_source_page_number_36’).val();gformInitSpinner( 36, ‘https://pivothearing.com/wp-content/plugins/gravityforms/images/spinner.gif’ );jQuery(document).trigger(‘gform_page_loaded’, [36, current_page]);window[‘gf_submitting_36’] = false;}else if(!is_redirect){var confirmation_content = jQuery(this).contents().find(‘.GF_AJAX_POSTBACK’).html();if(!confirmation_content){confirmation_content = contents;}setTimeout(function(){jQuery(‘#gform_wrapper_36’).replaceWith(confirmation_content);jQuery(document).scrollTop(jQuery(‘#gf_36’).offset().top – mt);jQuery(document).trigger(‘gform_confirmation_loaded’, [36]);window[‘gf_submitting_36’] = false;}, 50);}else{jQuery(‘#gform_36’).append(contents);if(window[‘gformRedirect’]) {gformRedirect();}}jQuery(document).trigger(‘gform_post_render’, [36, current_page]);} );} ); jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 36) {if(typeof Placeholders != ‘undefined’){

Placeholders.enable();

}jQuery(‘#input_36_3’).mask(‘(999) 999-9999’).bind(‘keypress’, function(e){if(e.which == 13){jQuery(this).blur();} } );} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [36, 1]) } );

Government Relief Programs

Paycheck Protection Program

Highlights:

The funding is intended to help retain workers, maintain payroll, and cover rent, mortgage, and utility expensesThere is no cost to applyThe loan covers expenses dating back to February 15 through June 30, 2020 Loan can be forgiven and essentially turn into a non-taxable grantNo personal guarantee or collateral is required

Action: Contact your local SBA-approved lender – you can reach the SBA by email at answerdesk@sba.gov or by phone at 1-800-827-5722

Further Information:

Paycheck Protection Program (SBA)Paycheck Protection Program ApplicationPaycheck Protection Program FAQ

Schedule a 1:1 COVID-19 Practice Response Consultation

Economic Injury Disaster Loan Assistance Program (EIDL)

Highlights:

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

Further Information:

EIDL Assistance Program Application

Schedule a 1:1 COVID-19 Practice Response Consultation

Family First Act

Highlights:

The Families First Coronavirus Response Act (FFCRA) requires certain employers to provide their employees with paid sick leave and expanded family and medical leave for specified reasons related to Covid-19. Employers will be reimbursed for the cost of eligible paid leave under these provisions in the form of tax credits. These regulations will remain in effect from 4/1/2020 – 12/31/2020. Employers with fewer than 50 employees may be exempt from certain provisions of the FFCRA if doing so would place an undue burden on the operations of the business.

Further Information

Employee PosterProgram OverviewQuestions and Answers

Schedule a 1:1 COVID-19 Practice Response Consultation

Practice Development Opportunities

Develop a Marketing Plan: Plan for coming out of the crisis strongerCreate a Physician Referral Marketing Plan: Develop a unique long-term lead generation programTake Your Message to the Community: Develop a prospective patient seminar presentationAnalyze Your Practice Business Data: Make changes that your business has been needing to stay healthyDevelop Clinical Tools: Improve and update your patient communication and appointment efficiencyAnalyze Your Digital Marketing / Presence: Make those enhancements and updates that set your business apartHone Your Value Proposition: Everyone in your community should know why you exist and why you are the best choice for hearing care in your communityPivot Hearing can help you develop and execute a project list for this time while your office is closed or slower than normal so that you emerge from the COVID-19 situation poised for new business cycle growth.

Schedule a Complimentary Practice Assessment

What we do

Increased Patient Flow

Pivot Hearing delivers increased patient flow through marketing plan development, execution, and digital transformation.

Lean Operations Design

Pivot Hearing helps you design lean operations to scale and dominate in a changing marketplace.

Premier In-Clinic Patient Experience

Pivot Hearing helps you create a premier in-clinic patient experience, including the Hearing Aid Test Drive™ process and sales training.

Schedule a Complimentary Practice Assessment